Reciprocal Discounts And Market Meltdowns

The global trade war finally kicks off, and everyone loses money!

For Trump’s critics, all of Trump’s tariff bluster is foreseeable, but it doesn’t make it less ridiculous to see it play out in front of our eyes.

Leading up to April 2, the president has touted the date as “Liberation Day” for America, believing that tariffs will finally begin to claw back the respect and money it has lost to other countries for decades, and spur domestic industries in the years to come. However, many experts argue the opposite, saying it “will hurt growth, raise prices, and worsen inequality.”

On Monday, Japan’s Nikkei index entered a correction after slumping 12% from its December peak, partly thanks to threats of American tariffs. In Europe, the European Central Bank chief, Christine Lagarde, said Trump’s tariffs should lead the continent to the “march to independence.” By the time US stocks opened, markets immediately began falling after Trump’s statement that tariffs could hit all trading partners. At the end of the day, the S&P 500 and the tech-heavy Nasdaq posted their worst quarter since 2022.

On the day before “Liberation Day,” Donald Trump said he had settled on his tariff plan that would take effect on Wednesday, with reports that indicate his advisors have suggested 20% universal tariffs to all nations. Domestically, auto sales have surged in fear of increased car prices, and Senate Republicans plan to join Democrats in opposing Trump’s tariffs. Meanwhile, the president of the European Commission, Ursula von der Leyen, said the EU has a “strong plan” to retaliate against tariffs imposed by the US.

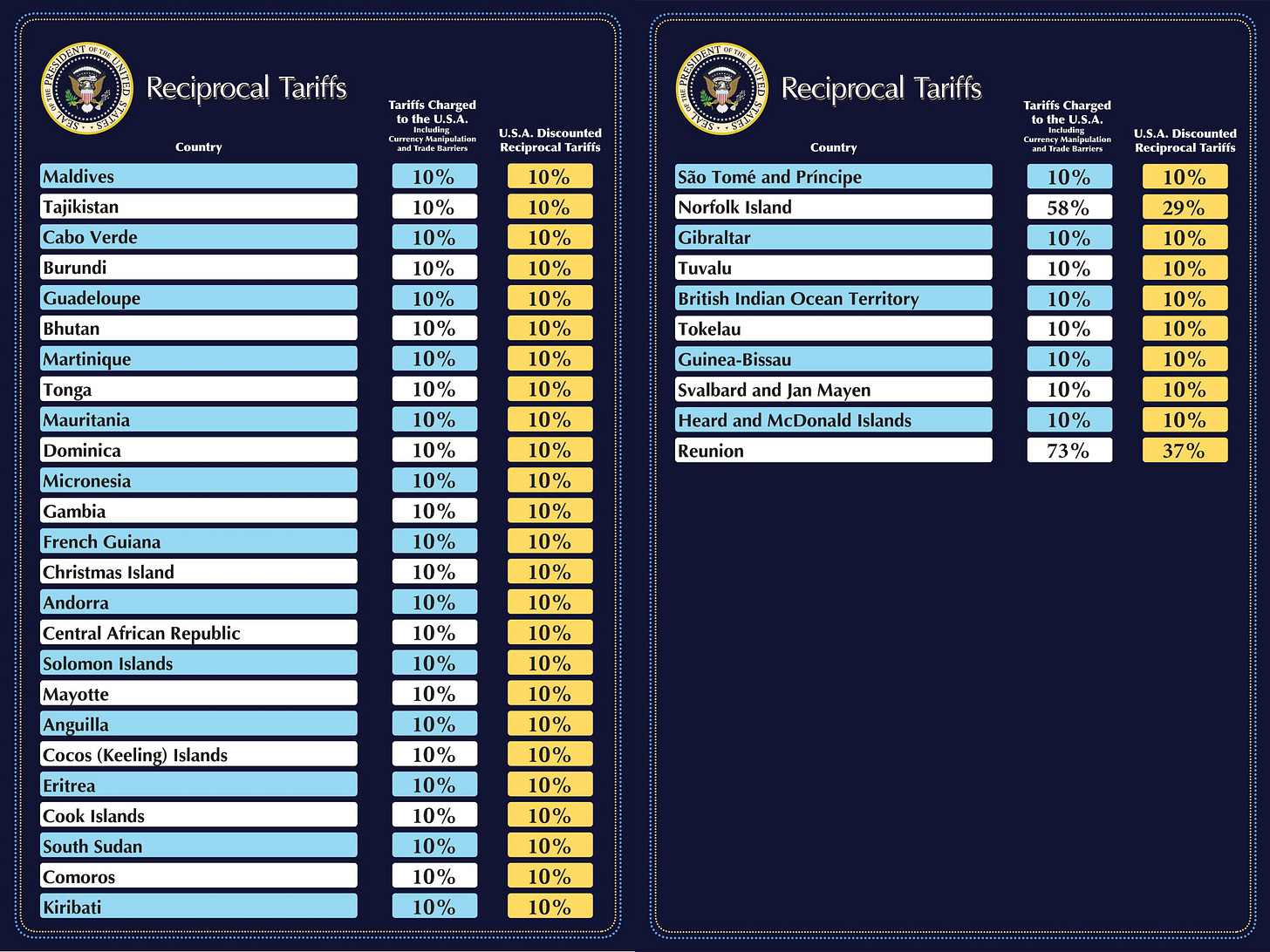

On the big day, the president announced his tariff plans in front of the Rose Garden. Before the ceremony, we already knew the 25% tariffs on imported cars and auto parts that would take effect on Thursday. As the stock market opened, the Dow immediately dropped by 300 points as Wall Street panicked over the tariff threats, and closed more than 200 points higher ahead of the rollout. Showing off a series of charts during the Rose Garden announcement, Trump rolled out the highest tariff rate since the 1800s, and the most severe tariff policy since the Smoot–Hawley Tariff Act was passed in the 1930s (Spoiler alert: There was a Great Recession following that). The president said there will be a new 10% tariff on all imported goods, with additional punitive import taxes tailored for 60 countries he sees as bad actors. Among the targeted countries, reciprocal measures include a 34% tariff on China, 20% on the EU, and 24% on Japan. Among the weirdest tariff recipients, Cambodia got slapped with 49% tariffs, North Korea and Russia received no new tariffs from the administration, while Trump slapped a 10% tariff on the Heard Island and the McDonald Islands, despite having a population of zero humans and being only inhabited by penguins. Good news for Canada and the UK, as the White House’s fact sheet exempted some of the US’s closest trading partners from facing additional punishment (Aside from the 10% blanket tariffs).

Here is the full list that the White House has posted for Liberation Day.

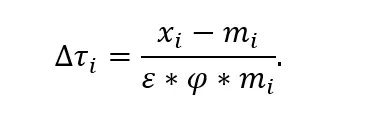

Just for fun, the Office of the United States Trade Representative released this dubious equation to explain how they calculated everything.

The markets reacted well, as the Dow futures tumbled by 1,000 points following the announcement. Four Senate Republicans joined Democrats in rejecting tariffs for Canada, showing signs of party dissent over the president’s economic policy. In Europe, as stocks fell before the announcement, Bloomberg reported the EU was preparing emergency measures to fund parts of its economy that might be targeted by tariffs. Trying to quell concerns, Treasury Secretary Scott Bessent urged US trading partners against retaliation, telling them to “wait and see” further developments.

Following Trump’s “Liberation Day” announcements, Asian stocks took a nose-dive. Japan's Nikkei 225 tumbled by 4%, while South Korean shares dropped by over 2%. In China, the mainland stock market slumped by a few points, and Hong Kong’s stock market reached a six-week low.

As China faced its biggest ever tariff hike that reached a total of 65%, Beijing vowed “retaliation” following Washington’s acts of “bullying.” As the EU condemned the tariffs as a “major blow to the world economy,” European Commission President von der Leyen said they were preparing further countermeasures against US tariffs if negotiations fail. Among the responses by other countries, Japan’s Trade Minister called the reciprocal tariffs "extremely regrettable," Canada’s PM Mark Carney said his country’s countermeasures would "act with purpose and with force," Mexico’s Claudia Sheinbaum said she would pursue a “comprehensive program” instead of a "tit-for-tat on tariffs," UK PM Keir Starmer said his country would respond to the economic impact with “cool and calm heads,” Australian PM Anthony Albanese said his country would negotiate with Trump to remove the tariffs, and acting South Korean President Han Duck-soo ordered emergency support measures for affected businesses.

As the clock struck midnight, Trump’s tariffs on imported vehicles took effect, which the president expects to spur investments and jobs in the US despite fears of increased auto prices for consumers. Volkswagen then said it would add an “import fee” to cars sold in the US, in the most direct example ever of how tariffs are passed down to the consumer.

On Thursday morning, US stock futures collectively took a massive fall, as the dollar tumbled to the lowest point in a year. Current tariff plan mastermind and Commerce Secretary Howard Lutnick tried to put a good spin amid all the economic chaos, claiming Trump's reciprocal tariffs will spur countries to examine their trade policies. When the stock market officially opened, the Dow cratered by more than 3.4%, while the S&P 500 headed for its worst drop in 2 years, dropping by 4.6%. By the end of the day, the damage was clear. The tariffs have led to Wall Street’s worst single-day wipeout since 2020, and European stocks closed the day 2.7% lower. The Dow dropped by 1680 points, the Nasdaq entered correction territory, while Apple led the tech sell-off by falling 9%. If you are curious whether the Trump administration was treating this seriously, the White House’s social media account tweeted a breezy photo of Trump after the stock market rout. Contradicting White House aides, Trump claimed he is open to tariff negotiations in return for “phenomenal” offers.

Just to give you a sense of how shambolic everything is, The Economist’s editor-in-chief, Zanny Minton Beddoes, put it best on just how unnecessary the tariff policies are, and how much of the damage is self-inflicted.

Watching President Donald Trump’s Rose Garden performance yesterday, it was hard to believe what I was seeing: flawed economics, inaccurate history and cockamamie calculations used to justify the most wrong-headed and damaging policy decision in decades. Mr Trump’s “Liberation Day” was more like ruination day. Our cover leader in most of the world predicts that these mindless tariffs will cause chaos. Almost everything Mr Trump said this week—on history, economics and the technicalities of trade—was deluded. He has long glorified the high-tariff era of the late 19th century. In fact, it was the painstaking rounds of trade talks in the 80 years after the second world war that lowered tariffs and led to unprecedented global prosperity, including for America.